Final week introduced continued progress within the struggle in opposition to the pandemic, and people phrases would work for this week as effectively. As we’re firstly of a brand new month, nevertheless, let’s check out the progress because the begin of April. Whereas weekly information is beneficial, the pandemic has now continued on for lengthy sufficient that we have now the info to determine a broader context—and that broader context is surprisingly optimistic.

Pandemic Slowing Even Additional

Development fee. You may see from the chart under that the brand new case progress fee went from greater than 15 % per day firstly of April to the current stage of about 2 % per day. Put one other method, the variety of new instances was doubling in lower than every week firstly of April; as we enter Might, that doubling fee has gone to greater than 5 weeks. This shift is a big enchancment—we have now succeeded in flattening the curve at a nationwide stage.

Each day testing fee. We have now additionally made actual progress on testing, with the day by day take a look at fee up from simply over 100,000 per day firstly of April to effectively over 200,000 per day firstly of Might. Whereas this stage remains to be not the place we want it to be, it represents actual progress.

Optimistic take a look at outcomes. One other method of seeing this progress is to have a look at the share of every day’s exams which are optimistic. Ideally, this quantity can be low, as we wish to be testing everybody and never simply those that are clearly sick. The decrease this quantity will get, the broader the testing is getting. Right here once more, we will see the optimistic stage has halved from the height. Extra persons are getting exams, which suggests we have now a greater grasp of how the pandemic is spreading.

New instances per day. The advance in new instances per day is much less dramatic, down from 30,000-35,000 to about 25,000. However this quantity is healthier than it seems. With the broader vary of testing and with the variety of exams doubling, different issues being equal, we might anticipate reported instances to extend in proportion to the variety of exams. In truth, we have now seen the variety of day by day instances ebb and circulate with the testing information. However total the development is down—by greater than 20 % from the beginning of April—regardless of the doubling within the variety of exams.

We proceed to make progress on controlling the coronavirus pandemic, however the level this week is how a lot progress we have now made. We’re not out of the woods but. However we’re on the finish of the start of the method and shifting in the best path.

Financial system Might Have Bottomed in April: Reopening Begins

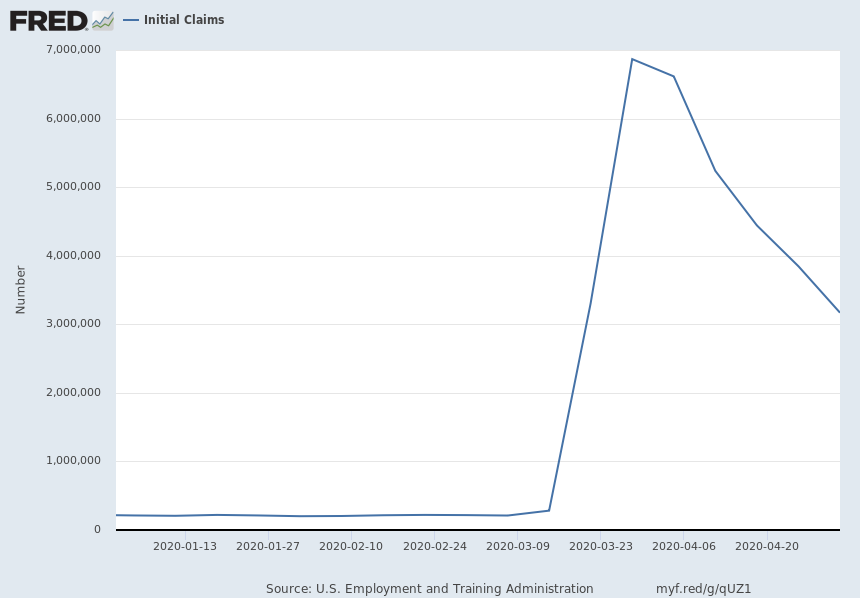

Whereas layoffs proceed, there are indicators that the injury could have peaked and is beginning to recede. Weekly preliminary unemployment claims are down by greater than half from the height, suggesting that a lot of the injury has already been performed. If the decline continues at this tempo, we might see layoffs normalize within the subsequent month. That decline doesn’t imply the economic system is sweet. It does imply the economic system is getting much less dangerous, which is a essential step in attending to good.

Federal help. Even because the financial injury mounts, the federal help can also be mounting. In the beginning of April, the applications weren’t in place. Now, substantial quantities of money are flowing into the economic system through the stimulus funds, expanded unemployment insurance coverage, and mortgage applications for companies, which ought to assist maintain demand alive till the economic system reopens (which could not be that lengthy).

Advantages of reopening. A number of European international locations have began to reopen their economies because the begin of Might, and numerous U.S. states are opening as effectively. As we reopen, we definitely face dangers, however there are additionally actual advantages. First, the rising indisputable fact that the lockdown does certainly have an finish ought to assist help client confidence, which is a essential ingredient of any restoration. Second, it can assist employment and spending, bringing a few of these laid-off workers again to work. Third, we’ll be taught quite a bit about how the reopening works, which is able to considerably scale back uncertainty going ahead.

Are there dangers? Definitely, the most important of which is a second giant wave of the pandemic. Reopening means loosening the social-distancing restrictions and exposing extra individuals to an infection threat, which might definitely inflate case counts. On the identical time, if individuals proceed to do issues like put on masks and preserve distance, that further case progress may be minimal. That can be one thing we’ll be taught, and it appears possible that most individuals will act in a secure method.

One other potential threat is that, even with the reopening, customers can be gradual to return and spending progress won’t return to what was regular any time quickly. This end result appears possible, particularly within the early phases. Right here once more, that is one thing that would find yourself doing higher than anticipated.

We must reopen in some unspecified time in the future. If we will accomplish that with out an excessive amount of further an infection threat, that can be price discovering out. And, the bigger-picture perspective right here is that firstly of April, we didn’t know whether or not we might management the pandemic or not. And a month later? We’re planning to reopen in lots of areas. That is actual progress.

Market implications. For the monetary markets, proper now the idea is that the reopening and restoration will go effectively and shortly. Markets are priced for a fast finish to the pandemic and a V-shaped financial restoration. If the Might reopening goes effectively, these assumptions will look a lot much less unsure—to the possible additional good thing about the markets.

Dangers within the Rearview?

Trying again over a month, the shocking factor is simply how a lot progress we have now made and the way we have now moved from one thing approaching panic to a measured strategy to reopening the economic system. We’re not but out of the woods, and there are definitely important dangers going ahead, with a second wave of infections being the most important. However the factor to remember is that most of the greatest dangers are shifting behind us.

Editor’s Notice: The unique model of this text appeared on the Unbiased

Market Observer.