Monarch Cash

Product Identify: Monarch Cash

Product Description: Monarch Cash is a budgeting app that may monitor your monetary progress and make it simpler to plan for the longer term.

Abstract

Monarch Cash is a budgeting app that tracks your spending in opposition to your funds and mechanically pulls your recurring bills right into a calendar format. You may as well monitor your internet value and investments. It additionally permits for limitless contributors.

Execs

- Mechanically downloads and categorizes transactions

- Calendar view of recurring costs

- Free so as to add different customers

- View brokerage account positions alongside banking balances

Cons

- No free plan

- No credit score rating monitoring

- Doesn’t sync with non-traditional monetary accounts

Are you in search of a monetary app that may monitor your banking accounts, aid you funds, and counsel methods to enhance your funds?

Monarch Cash is a well-liked budgeting app that permits you to see all of your monetary accounts in a single place. For instance, the app syncs to most financial institution accounts, enables you to create limitless budgets, and tracks your investments and internet value.

This Monarch Cash evaluate covers the assorted monetary instruments out there to you.

For a restricted time, Monarch is providing 30% off your first 12 months with the coupon code WELCOME. This code is legitimate beginning September twenty first, 2024.

At a Look

- Arrange a custom-made funds

- Mechanically identifies recurring bills

- Add limitless contributors to the funds

- Observe your internet value and investments

Who Ought to Use Monarch Cash?

Monarch is nice for monitoring all of 1’s monetary accounts in a single place. You possibly can see your funds and on a regular basis spending alongside your internet value. You possibly can create custom-made studies and check out completely different situations to see how they play out long run.

You may as well add limitless contributors to your funds, which is ideal for {couples} or these working with a monetary coach or advisor.

Alternate options to Monarch Cash

Desk of Contents

- At a Look

- Who Ought to Use Monarch Cash?

- Alternate options to Monarch Cash

- What Is Monarch Cash?

- How Monarch Cash Works

- Monarch Cash Options

- Finances

- Monetary Targets

- Funding Monitoring

- Recurring Expense Tracker

- Web Value Tracker

- Joint Funds

- Custom-made Charts

- Alternate options to Monarch Cash

- Cash Monarch FAQs

- Monarch Cash Evaluate: Remaining Ideas

What Is Monarch Cash?

Monarch Cash is a budgeting app and internet value tracker. It’s free for seven days, after which it’s $99 per 12 months.

A number of the intriguing options embody:

- A month-to-month funds

- Financial savings targets

- Web value monitoring

- Subscription administration

- Calendar view of upcoming payments

People and {couples} can funds collectively. You may as well add a monetary advisor as a collaborator to offer extra insights.

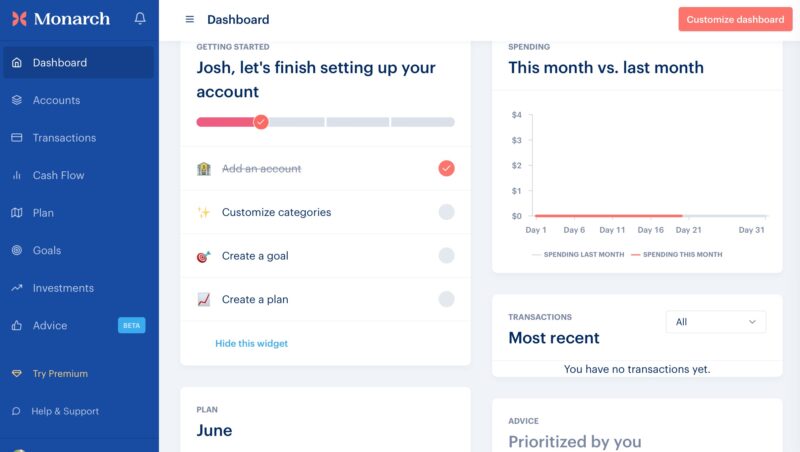

How Monarch Cash Works

You possibly can entry Monarch Cash by a cell app (Android or iOS) and the web web site.

Upon becoming a member of, the service will sync along with your financial institution and funding accounts (over 11,200 out there establishments). The free model permits you to join as much as two financial institution accounts, and funding monitoring is just for paid subscribers.

As soon as your accounts are related, the app walks you thru its varied capabilities, like budgeting and aim setting. Monarch will pull transactions out of your linked accounts, and you’ll assign a selected revenue or expense class to make an correct funds.

Because the months roll on, you possibly can log contributions for financial savings targets and act on the recommendation for different monetary subjects like retirement planning and getting needed insurance coverage.

Monarch Cash Options

Monarch Cash is full of instruments that can assist you monitor your spending and plan for future targets. Let’s take a better have a look at a few of its finest options:

Finances

In fact, a budgeting instrument could have a funds, but it surely’s place to start out, nonetheless. The month-to-month spending plan enables you to forecast upcoming month-to-month bills by class. Taking it additional, you possibly can rapidly examine your precise funds figures to your deliberate bills. You possibly can alter your deliberate class spending for every month to account for one-off occasions like a trip or an costly automobile restore.

The assorted funds classes are expansive and canopy probably the most frequent family bills, enterprise revenue, taxes, well being and wellness, and extra. You may as well customise the classes for revenue and bills to get a extra life like family funds.

Monarch Cash mechanically categorizes your transactions, however you need to alter a number of class assignments. You’ll most likely want to change the month-to-month funds’s deliberate and precise spending quantities – the identical goes for many funds software program.

Customizable funds classes are only a begin. A number of the different nifty options embody:

- Rollover budgets: Roll your month-to-month financial savings into subsequent month’s funds. This functionality makes monitoring your disposable revenue for all times’s variable bills simpler.

- Observe your progress: You possibly can all the time see precisely how you might be doing all through the month. This helps you keep on funds and makes it simpler to satisfy your targets. You may as well pull a month-to-month progress report.

- Check situations: You possibly can plug in numerous situations and see how they influence your long-term funds.

- Retirement planning: You possibly can see how your spending impacts your retirement plans.

Monetary Targets

As a substitute of making financial savings targets in your financial savings account, you possibly can construct them inside this platform to see your complete monetary image in a single place.

This function is just like different monetary platforms. You assign a financial savings aim and deadline. Then, as you put aside new funds for the aim, you possibly can replace your progress, which is displayed with an interactive graph.

Funding Monitoring

You possibly can sync limitless funding accounts to trace the efficiency of particular person shares and funds and even crypto. You possibly can view your allocations and see the historic efficiency of your investments.

You may as well see how your efficiency stacks up in opposition to benchmarks, such because the S&P 500 and VTI.

Recurring Expense Tracker

All of us have recurring bills, and Monarch will mechanically detect them and put them right into a calendar view. You may as well manually add recurring bills if wanted. This may be so useful for those who plan your funds based mostly on while you receives a commission. You’ll additionally get a reminder notification three days earlier than the invoice is due.

Web Value Tracker

The platform can monitor your money and funding balances to calculate your liquid internet value. You may as well estimate your private home worth by Zillow. If in case you have accounts that received’t sync, you possibly can add them manually.

Whereas this instrument is useful, it doesn’t monitor each internet value metric. Different providers specializing in monitoring internet value will be higher if this job is extra vital than budgeting.

Joint Funds

You possibly can add limitless collaborators, together with your partner, monetary advisor, grownup kids, and so on. This hands-on entry is obtainable to free and paid members.

With the ability to have a number of collaborators could make it simpler to construct a family funds. Should you’re in search of skilled monetary recommendation, your advisor can get their very own Monarch login, and Multi-factor Authentication (MFA), to (securely) aid you make a long-term plan. Different budgeting apps might cost additional for a number of customers, however that’s not the case with Monarch Cash.

Custom-made Charts

You possibly can create customized studies to see your spending patterns in the best way that works finest for you. You possibly can see issues like prime retailers, your financial savings fee, spending over a set date, spending by tags, and extra.

You possibly can export the photographs or obtain the information right into a spreadsheet.

Alternate options to Monarch Cash

There’s lots of competitors within the budgeting app area, and Monarch Cash has a number of rivals – names like Mint and YNAB. Listed here are some free and paid Monarch Cash options so that you can think about, if none of those are good match try listing of the finest budgeting apps for {couples}.

YNAB

Contemplate YNAB (You Want a Finances) for those who’re critical about budgeting. This app syncs with a number of units, together with computer systems, telephones, and wearables.

This program practices zero-based budgeting to assign a goal to each greenback you earn. The final word aim is to pay this month’s payments with final month’s revenue as a substitute of dwelling paycheck to paycheck.

After a 34-day free trial, you pay $14.99 per thirty days or $109 yearly with a one-time fee.

Whereas YNAB prices greater than Monarch Cash, it has extra in-depth budgeting options. As well as, it may be appropriate with extra units, making budgeting simpler. Study extra in our full YNAB evaluate.

Empower (previously Private Capital)

Empower is healthier for those who largely wish to monitor your internet value and funding efficiency. It’s additionally free to make use of. The service additionally has a primary budgeting instrument which will be useful when you have a agency grasp on dwelling inside your means and are prepared to extend your disposable revenue to save lots of for long-term targets.

Learn our full Empower evaluate to find the entire monetary instruments.

Lunch Cash

Lunch Cash is a budgeting app that, as anticipated, permits you to set spending classes. It then imports your transactions and categorizes them into your spending classes. It additionally mechanically identifies your recurring bills and permits for limitless collaborators. It can monitor your internet value, however you possibly can’t monitor your investments.

It prices $10 per thirty days or $100 yearly.

Study extra at our full Lunch Cash Evaluate.

Cash Monarch FAQs

Sure, an iOS and Android app can be found. The app might show unique studies that internet browser customers can’t entry. Moreover, the iOS app can monitor Apple Card purchases.

Sure. Monarch Cash makes use of bank-level safety to guard your monetary knowledge. The service received’t acquire delicate info similar to your Social Safety quantity. Moreover, the app makes use of Finicity, a third-party service, to hook up with your monetary accounts to keep away from storing your banking credentials on the Monarch server.

E-mail help is the one method to obtain hands-on assist. Paid subscribers obtain precedence help. A web based FAQ library or interactive function walkthroughs can assist you navigate the easy-to-use platform.

Monarch Cash Evaluate: Remaining Ideas

On the planet of budgeting apps, Monarch Cash is a stable selection. In my view, the fee is value it because it offers you lots of management over your funds and can possible be a internet constructive your monetary state of affairs.

It additionally permits you to monitor your investments and sync limitless accounts. Nevertheless, Private Capital is a superb various for this for those who don’t want in-depth budgeting instruments.

For a restricted time, Monarch is providing 30% off your first 12 months with the coupon code WELCOME. This code is legitimate beginning September twenty first, 2024.