Banks and credit score unions supply financial savings accounts and CDs. Brokers comparable to Vanguard, Constancy, and Charles Schwab supply cash market funds and Treasuries. They serve related functions at a excessive degree. Each a financial savings account and a cash market fund enable versatile deposits and withdrawals. Each CDs and Treasuries supply a hard and fast rate of interest for a hard and fast time period.

| Banks and Credit score Unions | Brokers | |

|---|---|---|

| Versatile Deposits and Withdrawals | Excessive Yield Financial savings Account | Cash Market Fund |

| Fastened Time period | CDs | Treasuries |

Whereas most discussions on these merchandise from banks and brokers focus on having FDIC insurance coverage or not (see No FDIC Insurance coverage – Why a Brokerage Account Is Secure), many individuals don’t understand that there’s a basic distinction between the roles banks and brokers play. I discussed this distinction in my Information to Cash Market Fund & Excessive Yield Financial savings Account. It’s price highlighting it once more.

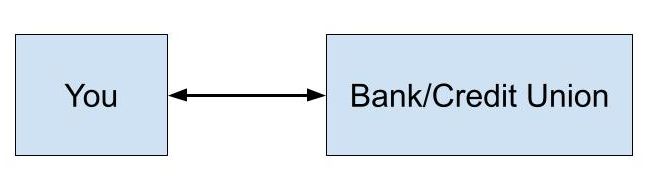

The elemental distinction is that banks and credit score unions supply a two-party personal contract whereas a dealer serves as an middleman between you and the general public market.

Two-Celebration Non-public Contract

A two-party personal contract means something goes so long as one celebration makes the opposite celebration comply with the phrases. If a financial institution will get you to comply with a 0.04% fee in a financial savings account or a 0.05% fee in a 10-month CD (these are precise present charges from a big financial institution), that’s what you’ll get no matter what the speed ought to be. The financial institution units the speed. They don’t must justify it. You get a nasty contract for those who aren’t conscious of the going fee.

A nasty contract doesn’t need to be this apparent. It’s been over a yr now because the Fed raised the short-term rates of interest above 5%. The speed on a “good” on-line high-yield financial savings account such because the one from Ally Financial institution is at the moment 4.2% whereas a cash market fund pays 5% or extra. It’s 4.2% from the financial institution solely as a result of the financial institution says so. You’re paying a “familiarity penalty” once you stick with Ally.

I’m not selecting on Ally particularly. It really works the identical at Marcus, Synchrony, Amex, Uncover, Capital One, or Barclays. Ken Tumin, the founding father of DepositAccounts.com, made this commentary in April 2024:

If you happen to take a step again and ask why banks can profit from buyer inertia within the first place, you understand that’s the character of a two-party personal contract. Prospects should take the initiative to interrupt out of a nasty contract.

Some banks play methods by providing a brand new financial savings account below a distinct identify with aggressive charges whereas conserving the speed low on the present financial savings accounts. The speed is low on the present account solely as a result of that’s the contract you agreed to. The financial institution isn’t obligated to maneuver you to the brand new program as a result of that’s not within the contract. Nor does the financial institution need to let you know you could swap to the brand new program to get a better fee. It’s as much as you to search out out and take motion.

Charges at many giant credit score unions aren’t any higher. I’m a member of a well-regarded credit score union. It’s the biggest credit score union within the nation by far, with 3 times the belongings of the second-largest credit score union. The speed on its financial savings account is 1.5% when you’ve got $50,000 within the account. That’s 3.5% decrease than the yield in a cash market fund.

A very good contract right now can flip into a nasty contract tomorrow. How the contract will change is within the contract itself. A financial institution provides 5.0% APY on a 13-month CD right now. That’s an OK fee however what occurs after 13 months? You agree within the contract it can mechanically renew to a 12-month CD at a fee set by the financial institution at the moment except you’re taking particular actions to cease it inside a brief window. Guess what fee the financial institution will set on its 12-month CD? Nearly all the time a nasty one. It really works this manner since you agreed to the contract.

When you’ve got a two-party personal contract, your curiosity is in direct battle with the opposite celebration within the contract. The onus is on you to know whether or not the contract is sweet or dangerous. It’s on you to look at when a superb contract turns into a nasty contract. Caveat emptor. You’ll have to leap from contract to contract for those who don’t wish to get caught in a nasty contract.

Some persons are extra alert in monitoring and leaping. They’ve an opportunity to “beat the market” however they pay for it with a heavy psychological workload and time spent on opening new accounts and shutting previous accounts. Many fail to be vigilant sooner or later. They begin paying the “familiarity penalty” as a result of it’s too tiring in any other case.

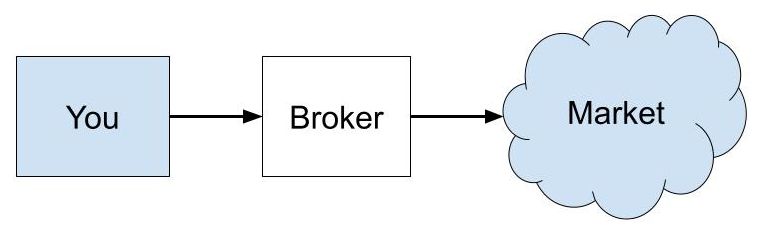

Market Middleman

A dealer acts as an middleman. They get you the market fee and take a lower. A dealer doesn’t set the speed. The market does. The dealer solely units its lower.

A cash market fund will get you the market fee on cash market securities minus the lower by the fund supervisor. Some fund managers take a much bigger lower than others however the distinction between main gamers is far smaller and extra secure than the distinction between charges supplied by totally different banks and credit score unions. If you happen to use a cash market fund with the smallest lower, comparable to one from Vanguard, you virtually assure you’ll have the most effective fee in a cash market fund always.

You continue to pay a “familiarity penalty” once you use a cash market fund from Constancy or Schwab versus one from Vanguard however the distinction is within the 0.2%-0.3% vary whereas the “familiarity penalty” in financial institution financial savings accounts may be greater than 1%. The “familiarity penalty” is zero or negligible in shopping for Treasuries via Constancy, Schwab, or Vanguard.

Treasuries don’t trick you into renewing at a nasty fee. They mechanically pay out at maturity. You’ll get the market fee once you purchase once more. If the dealer provides the “auto roll” function and also you allow it at your selection, your Treasuries will mechanically renew on the market fee. You possibly can relaxation assured that you simply received’t be cheated.

Cash market funds and Treasuries paid little or no when the Fed saved rates of interest at zero and ran a number of rounds of Quantitative Easing just a few years in the past. That wasn’t cash market funds’ fault or brokers’ fault. These have been the market charges at the moment. Like investing in index funds, you quit the dream of “beating the market” once you put your cash in cash market funds and Treasuries however you additionally constantly get the market charges always. It doesn’t require conserving your guard up, monitoring rigorously, or leaping.

If you wish to constantly earn a superb yield with low upkeep, ditch banks and credit score unions. If you happen to usually preserve cash in a financial savings account at a financial institution or a credit score union, put the cash in a cash market fund at a dealer. Listed here are some selections at Vanguard, Constancy, and Schwab:

These are good beginning factors. You’ll find extra money fund selections in Which Vanguard Cash Market Fund Is the Greatest at Your Tax Charges, Which Constancy Cash Market Fund Is the Greatest at Your Tax Charges, and Which Schwab Cash Market Fund Is the Greatest at Your Tax Charges.

If you happen to usually purchase a CD from a financial institution or a credit score union, purchase a Treasury of the identical time period at Vanguard, Constancy, or Schwab. See How To Purchase Treasury Payments & Notes With out Price at On-line Brokers and Methods to Purchase Treasury Payments & Notes On the Secondary Market.

I used to have many accounts with banks and credit score unions. I’ve solely $60 in financial institution accounts now. My money is in cash market funds and Treasuries in a Constancy brokerage account. Bank card payments mechanically debit Constancy on the due date. Constancy mechanically sells a cash market fund to cowl the debits. See 2 Methods to Use Constancy as a Financial institution Account.

The Fed has signaled that they might decrease rates of interest quickly. I don’t assume they’ll lower charges all the way in which again to zero once more. If at some point banks and credit score unions begin paying extra on their financial savings accounts and CDs than cash market funds and Treasuries, which I doubt will occur, I’ll nonetheless follow cash market funds and Treasuries as a result of I just like the transparency and equity. I’d quite get the market fee always than rely on the benevolence of a financial institution or a credit score union.

Say No To Administration Charges

In case you are paying an advisor a share of your belongings, you might be paying 5-10x an excessive amount of. Discover ways to discover an unbiased advisor, pay for recommendation, and solely the recommendation.