By Ker Thao, Maria Serenade, and Elwyn Panggabean

Globally, the rising youth inhabitants presents a possible for financial development. Nevertheless, youth in growing international locations additionally nonetheless face obstacles to entry monetary companies, reminiscent of three of 10 million Cambodian younger adults who stay financially underserved.

Youth financial savings, specifically, has immense potential for bettering a rustic’s gross financial savings price, asset-building and instilling wholesome monetary habits in prospects. At Ladies’s World Banking (WWB), we’ve seen again and again the social and monetary returns for monetary service suppliers that acknowledge this chance.

In Cambodia, WWB and AMK Microfinance Establishment designed and piloted options to drive younger grownup buyer engagement and financial savings, leveraging WWB’s women-centered design methodology. On this weblog, we share 5 design ideas which might be efficient in growing product consciousness, account acquisition and activation amongst Cambodian younger adults (YA).

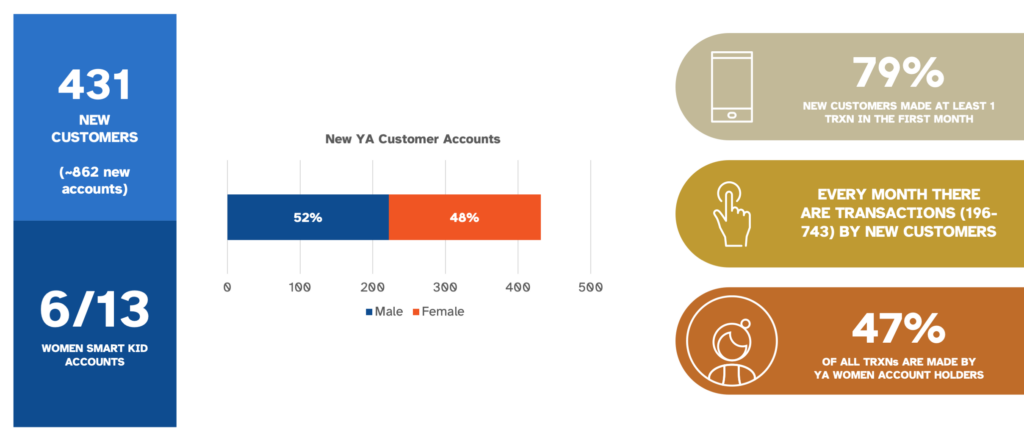

These 5 guiding ideas led to 431 new YA prospects (ages 18-35) between February-Might 2023, with 79% of recent prospects making at the least one transaction within the first month. Of those new prospects, 48% (209) had been feminine prospects. With our methodology, we proceed to see product adoption charges on common are the identical for women and men, whereas with out this technique girls prospects are typically left behind.

Pilot Outcomes and Analysis: Elevated Consciousness and Engagement

Our earlier buyer analysis has knowledgeable us that monetary literacy and capabilities amongst low-income Cambodian younger adults are low. Nevertheless, there’s a demand for elevated digital literacy, accessible, and reliable digital monetary companies.

On account of these learnings, we piloted our monetary options between February-Might 2023 and focused non-student YA and YA College college students between the ages of 18 and 35.

The general pilot reached a complete of 71,144 younger adults by on-line (digital advertising through Fb) and offline (on-site sales space activation at universities) campaigns and engagement actions, of which 431 new prospects opened an AMK account, with 79% of recent prospects making at the least one transaction within the first month. Of those new prospects, 48% (209) had been feminine prospects.

The 5 Design Rules that Led to 431 New AMK Prospects

Based mostly on prior buyer analysis, we created answer elements that targeted on elevating buyer consciousness by campaigns, learn-by-doing approaches to construct digital monetary capabilities, and incentives to assist construct monetary behaviors and encourage prospects.

These elements boiled down to 5 core design ideas. With these ideas, we search to assist monetary service suppliers attain out to YA girls prospects and supply them with accessible digital monetary options.

1. Increate total visibility and model

The general pilot reached a complete of 71,144 younger adults by on-line (digital advertising) and offline (on-site sales space activation at universities) campaigns and engagement actions, growing model consciousness amongst YA, particularly YA girls. Leveraging channels that YA want and use, reminiscent of Fb, YouTube, and Instagram, can assist attain the best viewers and assist them make knowledgeable choices on what monetary services can be found to them. By the social media campaigns alone, we reached 35,958 girls prospects by static and video posts on Fb.

2. Present Clear worth proposition

For monetary establishments who haven’t served YA girls segments beforehand, there’s a must re-position themselves to achieve these prospects. It requires speaking its advantages and values that talk to the potential youthful prospects. We took an energetic method by organising college cubicles to introduce AMK as a reliable monetary supplier, the place YA college students may be taught extra about AMK and concerning the financial savings account focused in the direction of them.

“I needed to have a separate account for my financial savings. I additionally seen that AMK offers Loyalty Factors on high of a excessive rate of interest. So, I believe it’s a good match and relevant for college students to avoid wasting up.” – 24-year-old Kampung Cham Province feminine pupil

3. Guarantee easy accessibility and usefulness of digital accounts

YA are typically extra tech-savvy and infrequently want to transact digitally. Guaranteeing a simple and accessible transaction expertise is taken into account a top-of-funnel purpose. Our answer offered straightforward cash-in and cash-out factors that helped prospects fund their digital accounts and actively use, whereas additionally guaranteeing prospects may retrieve their cash when wanted. That is essential for pupil cashflow and wishes, particularly for college charges, provides, and day by day wants.

4. Study-by-doing session

In-person help is confirmed efficient in buying new prospects. Different useful instruments are video tutorials to teach new prospects about merchandise, easy methods to use them, and might promote wholesome monetary habits. Our answer offered each in-person studying periods together with video tutorials out there immediately through the cellular banking software. We see that YA are extra tech-savvy and infrequently in a position to navigate and like studying by themselves. Offering accessible studying tutorials assist support of their curiosity to discover extra digital use circumstances.

5. Construct digital monetary capabilities

Given the prevalence of digital banking, the answer helped YA girls acquire confidence in utilizing cellular banking for top-ups and transfers. We used a number of channels to remind and encourage prospects, reminiscent of Fb posts and push-notifications conveying messages which might be related to their wants to make use of their cellular banking app.

As core buyer bases start to age, as in AMK’s case, understanding the wants, challenges, and alternatives of serving YA, particularly YA girls prospects, might be an vital step to make sure that also they are financially included. Whereas low-income YA girls prospects face related challenges with digital and monetary literacy and expertise, our learnings and design ideas present a pathway in the direction of creating sustainable merchandise and methods to achieve, educate, and assist younger grownup girls prospects use digital monetary companies and merchandise. If monetary service suppliers can present monetary companies, reminiscent of financial savings, for YA earlier than they attain maturity, they will domesticate a brand new technology of financially included, knowledgeable and empowered prospects who can higher plan for and put money into their futures. On the enterprise aspect, monetary service suppliers have the chance to be the financial institution of alternative for this buyer over their lifetime.

This work has been made doable because of funding help from the Australian Authorities’s Division of Overseas Affairs and Commerce (DFAT).