Earlier this week I wrote about how America is the envy of the world.1

There was loads of pushback. Many Europeans identified now we have loads of different issues plus a far worse security internet than they do. Truthful sufficient.

There have been additionally loads of feedback on inequality, though I addressed that within the piece. It’s value noting analysis reveals 40% of the rise in earnings inequality has been undone since 2020. That’s progress you by no means hear about.

One of the best financial counterpoint got here from these arguing 3% actual GDP development is nothing to have a good time. That’s higher than the remainder of the developed world however I needed to do a deeper dive on this one.

There are two fundamental methods an economic system can develop over time:

(1) Inhabitants development. Extra folks means extra employees, which suggests folks spend extra, corporations make more cash, so folks earn extra, and so on.

(2) Productiveness development. Employees are extra environment friendly and productive with their time due to enhancements in know-how and elevated information/schooling.

If we would like first rate financial development sooner or later, we both want extra folks on this nation or to turn into extra productive.

Whenever you have a look at inhabitants development in america it is sensible financial development would start to start to gradual.

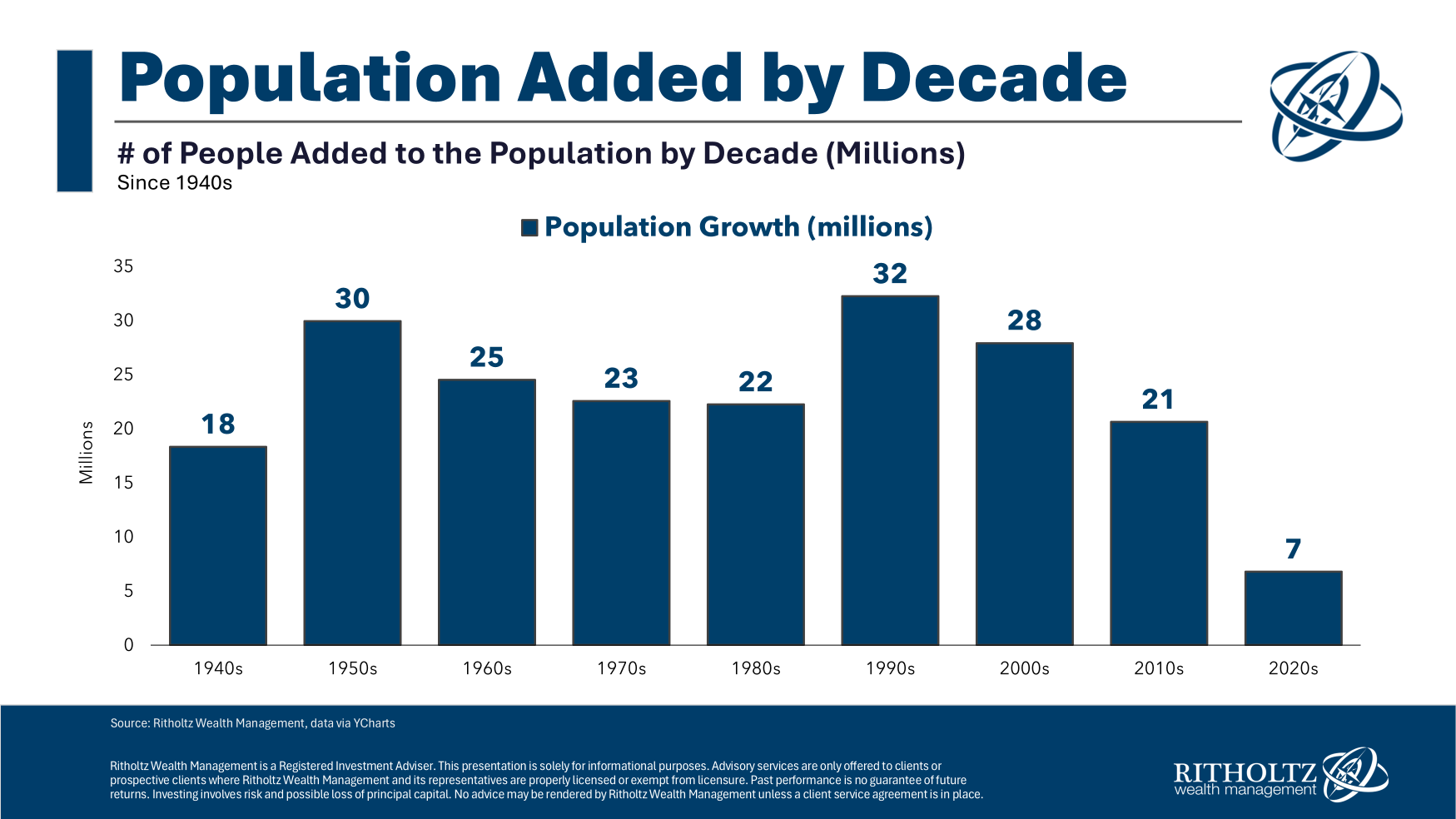

Right here is absolutely the inhabitants development by decade going again to the Forties:

This quantity has been comparatively regular over time. Nevertheless, as the general inhabitants has grown, the relative quantity of development has shrunk.

There have been round 130 million folks within the U.S. by 1940. By the tip of 2023, it was estimated to be extra like 335 million.

Right here is inhabitants development on a share foundation:

Relative to the general inhabitants, America skilled huge development within the Forties and Nineteen Fifties. It’s been on a gradual decline ever since.

Now have a look at actual GDP development by decade:

It’s not an ideal relationship as a result of many different elements are at play however you’ll be able to definitely see issues transferring in the same course. The purpose is the development in development has been happening for many years now.

As inhabitants development has decelerated, so too has financial development.

Plus we’re a much bigger, extra mature economic system now. We are able to’t count on to see 4-5% GDP development anymore with a $29 trillion economic system.

It’s important to measure an economic system relative to its potential. The US has been dwelling as much as its potential. The remainder of the developed world has not:

There may be one issue associated to financial development I failed to say — authorities spending.

That’s clearly been an enormous purpose for our success this decade.2

There are many folks fearful about deficit spending and the dimensions of presidency debt:

I’ve loads of ideas on that subject as properly.

Keep tuned and I’ll have one thing subsequent week on authorities funds.

Michael and I talked concerning the power of the professionals and cons of the U.S. economic system and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

The Backside 50%

Now right here’s what I’ve been studying these days:

Books:

1The Economist’s phrases, not mine (though I agree).

2Though the remainder of the world spent loads of cash in the course of the pandemic too however didn’t expertise the identical ranges of development. They usually did expertise the identical ranges of inflation.

This content material, which comprises security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here shall be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or provide to supply funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.