Rocket Cash

Product Identify: Rocket Cash

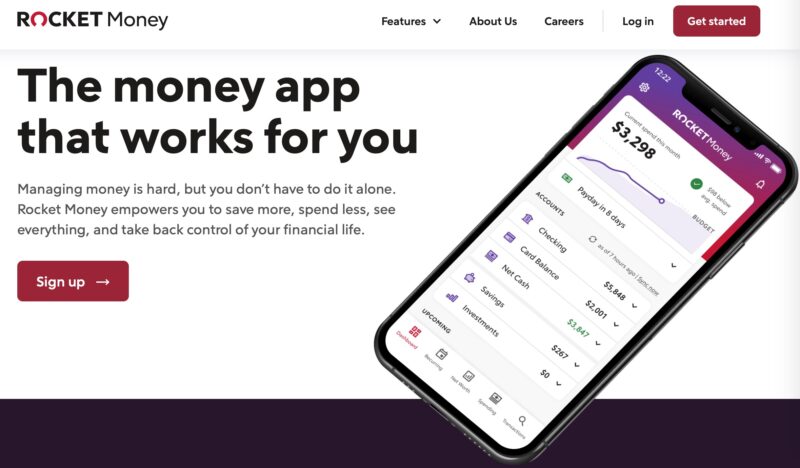

Product Description: Rocket Cash is a budgeting app with a number of cash administration options, together with subscription administration.

Abstract

Rocket Cash is an app with a number of options that can assist you handle your cash. Its subscription administration options make it straightforward to see all of your subscriptions in a single place. The app additionally offers step-by-step directions on learn how to cancel subscriptions, or when you have a paid plan, it can cancel them in your behalf.

Professionals

- A free plan is offered

- Subscription administration

- A number of cash administration options

- “Pay what’s truthful” possibility on the Premium plan

Cons

- Greatest options require a paid subscription

- Credit score rating monitoring solely updates month-to-month

Rocket Cash is an app that may enable you to handle your funds, cancel undesirable subscriptions, and negotiate your present payments. Along with subscription administration, it lets you monitor your credit score and web price.

The budgeting options sync together with your accounts, permitting you to categorize your transactions in opposition to your funds simply.

There’s a free plan and a “pay-what’s-fair” plan that prices between $6 and $12 per 30 days.

At a Look

- Subscription administration and cancelation companies

- Invoice negotiation companies

- Budgeting options

- Credit score and web price monitoring

- Free and paid plan out there

Who ought to use Rocket Cash

Rocket Cash’s greatest options are the subscription administration and the invoice negotiation service. In case you wrestle to beat the friction of canceling undesirable subscriptions, Rocket Cash is a should. It can pull all of your subscriptions into one place. On the free plan, it offers step-by-step directions on learn how to cancel and can cancel them for you on the paid plan.

The invoice negotiation service is offered on each plans; you’ll pay a share of your financial savings.

Options to Rocket Cash

Desk of Contents

- At a Look

- Who ought to use Rocket Cash

- Options to Rocket Cash

- What Is Rocket Cash?

- How Does Rocket Cash Work?

- Rocket Cash Options

- Account Syncing

- Handle Subscriptions

- Invoice Cancellation

- Invoice Negotiation

- Budgeting Options

- Sensible Financial savings

- Web Price Tracker

- Credit score Rating Monitoring

- Rocket Cash Pricing

- Is Rocket Cash Protected?

- Options to Rocket Cash

- FAQs

- Is Rocket Cash Price It?

What Is Rocket Cash?

Rocket Cash is a budgeting app for Android and Apple units.

There are each Free and Premium plans, every with numerous perks.

A few of the member perks embrace:

- Account monitoring

- Subscription administration

- Steadiness alerts

- Subscription cancellation assistant

- Invoice negotiation

- Budgeting

- Credit score rating monitoring

- Web price monitoring

You’ll get probably the most from Rocket Cash if you happen to use it to watch your spending and the subscription administration instruments. Its free instruments make it a great budgeting app, however the premium subscription stays inexpensive if you happen to don’t want hands-on budgeting assist.

How Does Rocket Cash Work?

You may observe these steps to be a part of Rocket Cash:

- Obtain the Android or Apple cellular app

- Hyperlink your monetary accounts

- Analyze spending habits

- Search for methods to economize

- Create budgeting and financial savings targets

- Monitor monetary progress with common updates.

Rocket Cash Options

Account Syncing

Rocket Cash hyperlinks your banking, bank card, and funding accounts by way of Plaid. This third-party service has read-only entry and doesn’t retailer your delicate particulars for additional privateness.

Your account balances replace day by day the primary time you log into your account. The app will ship spending insights and alerts when direct deposits hit your account. Linking as many accounts as potential makes it straightforward to see how a lot you spend and earn precisely.

After linking your accounts, you’ll be able to start categorizing your transactions. Rocket Cash auto-categorizes most transactions, so the continuing upkeep necessities are minimal.

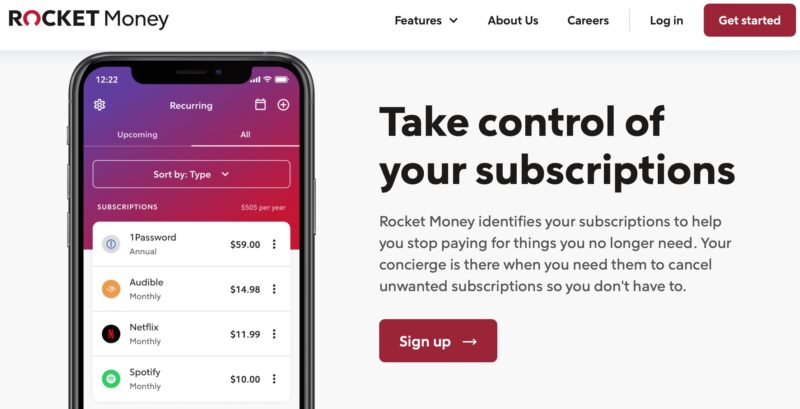

Handle Subscriptions

This characteristic is one in every of Rocket Cash’s most helpful options.

Chances are you’ll intuitively have a ballpark estimate about your mounted dwelling bills, corresponding to utility payments, meals, and childcare. What about your subscriptions? Particularly subscriptions that invoice yearly. It’s very straightforward to overlook about these payments till it’s too late, and also you’ve by accident paid for one more 12 months.

After linking your accounts, Rocket Cash seems by way of your transaction historical past for recurring subscriptions and lists them in a single place so you’ll be able to simply see them.

This characteristic is an effective train in figuring out which companies you frequently use and the others you’ll be able to stay with out.

Invoice Cancellation

Premium subscribers can have the app cancel subscriptions on their behalf. Free customers will obtain step-by-step instructions to cease service, which might prevent time regardless of doing the exhausting work your self.

This characteristic is useful if you happen to’re the sort to maintain pushing aside canceling as a result of it takes too lengthy or — if you happen to’re like me — you aren’t precisely certain learn how to do it, so that you simply don’t.

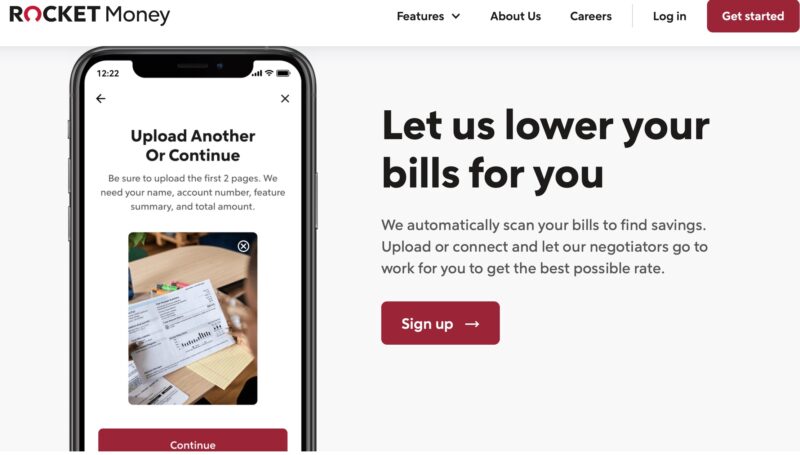

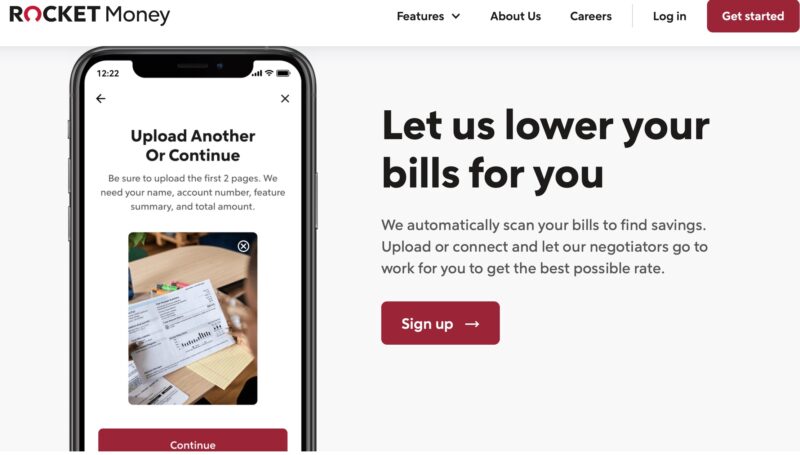

Invoice Negotiation

All subscribers can see if Rocket Cash will negotiate your present payments for a decrease price. This is a wonderful train to apply no less than annually for companies you’ll be able to’t stay with out to make sure you’re paying the most effective value.

A few of the greatest financial savings alternatives embrace:

- Cable or satellite tv for pc TV

- House Web

- Postpaid telephone plans (i.e., Verizon Wi-fi, AT&T, and T-Cell)

- Satellite tv for pc Radio

- Newspapers

Cable payments and contract cellphone plans have probably the most potential for reductions. The invoice negotiator might even see if they’ll swap you to a more moderen plan that has the identical options as your present plan however is cheaper. There may additionally be loyalty bonuses or limited-time promotions that may cut back your invoice for the next 12 months.

The service claims to have an 85% success price in reducing your payments. You pay a one-time success charge and get to resolve how a lot of the primary 12 months of financial savings to contribute as fee.

Rocket Cash also can strive to economize on these bills:

- Automotive insurance coverage

- Financial institution overdraft charges

- Invoice fee late charges

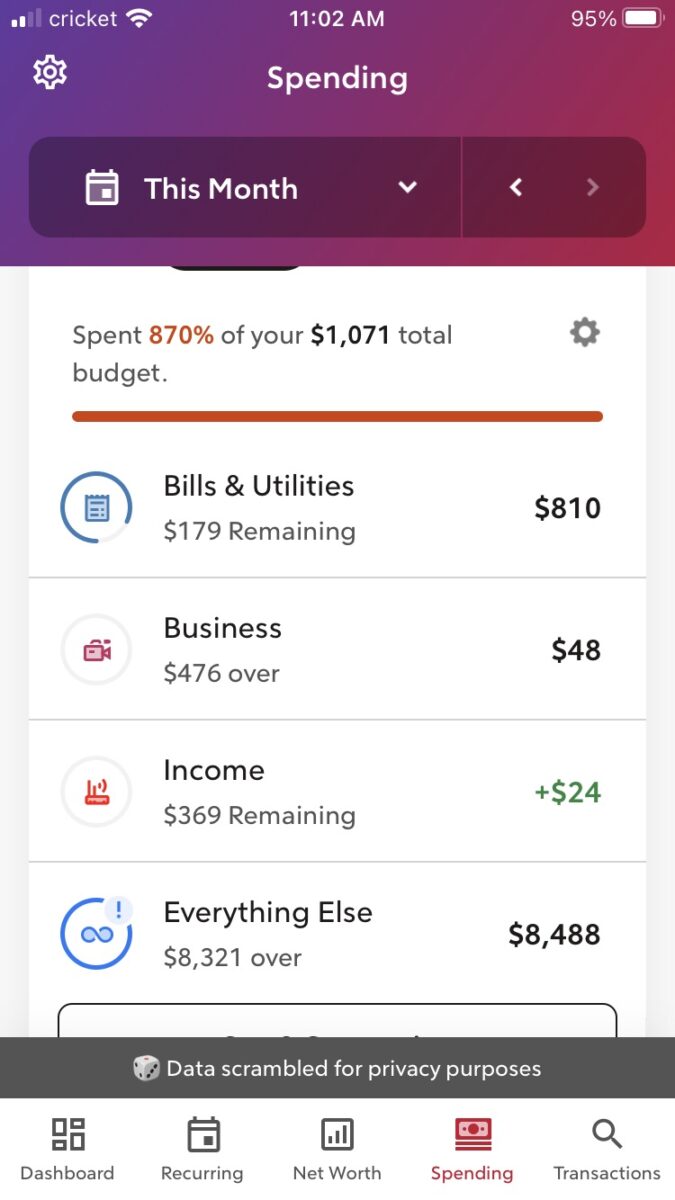

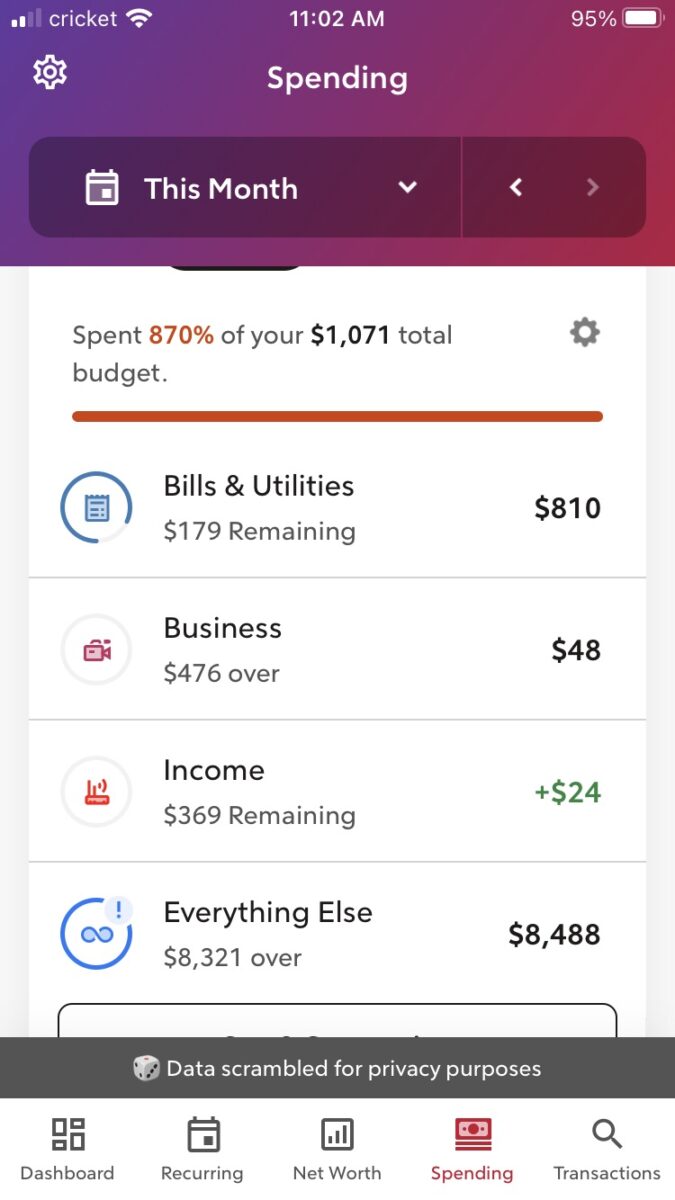

Budgeting Options

Along with real-time spending alerts and direct deposit notifications, Rocket Cash helps you to create a easy spending plan. The budgeting instruments should not as highly effective as some free budgeting instruments, however they may help you shortly see if you happen to’re dwelling inside your means for the month.

This budgeting app generates a month-to-month report summarizing your spending and earnings patterns. It’s additionally potential to investigate these subjects all through the month:

- Payments paid

- Present spending

- The earnings left for financial savings.

- Cash left for spending

- Month-to-month earnings thus far

Most reviews can be found on a weekly, month-to-month, quarterly, or yearly interval.

Premium members can create limitless budgets and use account sharing so you’ll be able to funds with one other premium member.

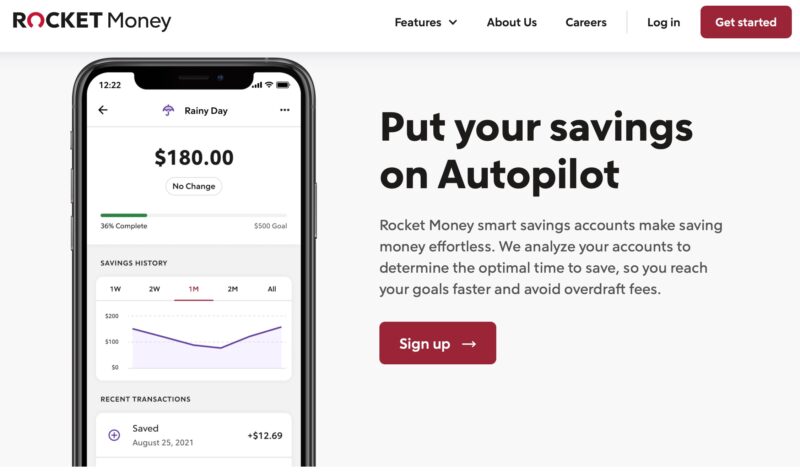

Sensible Financial savings

Premium subscribers can use the Sensible Financial savings characteristic to contribute to their financial savings targets mechanically. You may resolve how a lot to save lots of and the way often to withdraw out of your linked checking account.

To forestall account overdrafts, the service skips withdrawals when you could have inadequate funds in your account.

Your money goes into an FDIC-insured account till you’re able to spend it. Sadly, you might not earn curiosity on these deposits. As an alternative, think about a high-yield financial savings account to earn a living in your short-term financial savings.

Web Price Tracker

Premium members also can observe your web price by way of your linked accounts. This characteristic is probably not as important as budgeting or monitoring spending, but it surely’s one other approach to monitor your monetary progress.

There are extra highly effective web price monitoring instruments, however Rocket Cash does an sufficient job.

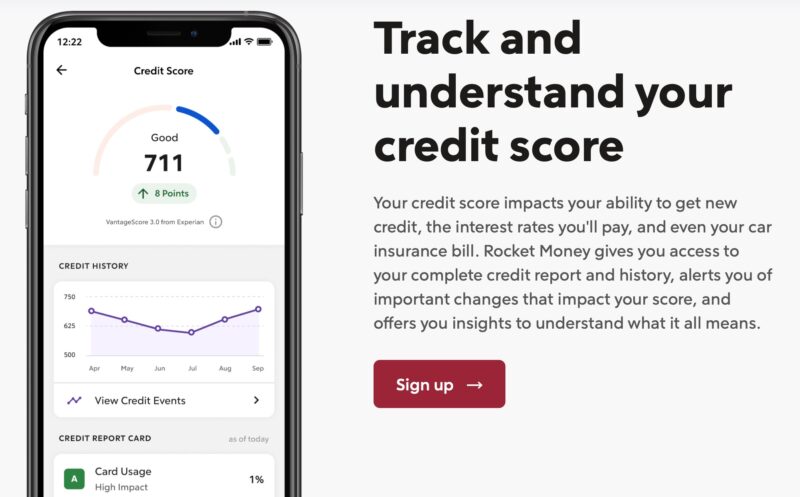

Credit score Rating Monitoring

Free customers can view their Experian VantageScore 3.0 credit score rating totally free. The app refreshes your rating month-to-month. Though this isn’t the identical rating that the majority lenders use to make credit score selections (that will be the FICO Rating from the Truthful Isaac Company), it provides you with estimate of your creditworthiness.

You may as well see areas of enchancment that may enable you to obtain credit score rating. Nonetheless, free subscribers received’t be capable to entry their credit score report.

Premium members can view their full Experian credit score report. This report updates month-to-month, so you should definitely entry it frequently to keep away from lacking an replace.

It is a good characteristic, and it helps assess your full monetary image. Take into account there are a number of methods to verify your credit score rating totally free with extra fixed updates. Different credit score monitoring companies could retrieve your rating from extra credit score bureaus and probably supply your FICO Rating.

Rocket Cash Pricing

Two completely different membership plan choices can be found: Lite and Premium. Pricing for Lite is free, and Premium is $3 – $12 however contains a “Pay What’s Truthful” possibility, which I’ll clarify in additional element beneath.

A 7-day free trial is offered on the Premium plan.

Free

The Lite plan is the usual possibility and is free for all times.

Its advantages can get the job completed and embrace the next:

- Account linking

- Steadiness alerts

- Subscription administration

- Spend monitoring

- Day by day account syncing

The free plan is greatest if you wish to monitor your spending and account balances however don’t want hands-on assist canceling or negotiating a cheaper price for recurring payments.

The budgeting instruments are restricted to 2 classes, which might be enough to keep away from overspending in your most vital month-to-month bills.

Premium: $6-12 / month

The Premium plan presents a 7-day free trial, and then you definately select to pay between $6 and $12 per 30 days. This app follows a “Pay What’s Truthful” technique, so you’ll be able to resolve how a lot to spend.

In accordance with Rocket Cash, the typical paid consumer pledges $6.99 month-to-month.

That will help you resolve if Rocket Cash Premium is price it, these are the out there perks:

- Limitless budgets

- Credit score rating and full credit score report (vs. credit score rating solely)

- Automated subscription cancellations

- Invoice cancellation concierge

- Web price monitoring

- Actual-time account syncing (vs. day by day syncing)

- Shared accounts

- Premium chat

- Export information

You may need to improve to the premium plan if you’d like limitless budgets, shared accounts, or automated subscription administration instruments.

Is Rocket Cash Protected?

Sure, Rocket Cash is a secure approach to monitor your banking account transactions, search for methods to cut back spending, and observe your credit score rating.

Most private finance software program apps use the identical third-party service (Plaid) to connect with your accounts. This software program doesn’t retailer private info on its servers and makes use of bank-level safety to guard your account. As well as, when you want to share your information with others, you’ll be able to scramble it for extra privateness.

Options to Rocket Cash

Rocket Cash may help enhance your funds, however these different companies might be higher if you happen to want hands-on assist with a particular want. If none of those sound good, additionally try our listing of the greatest budgeting apps for {couples}.

You Want A Price range (YNAB)

If you’d like a critical funds and to cease dwelling paycheck to paycheck, You Want A Price range (YNAB) is a wonderful possibility. YNAB isn’t free, although; it prices $14.99 month-to-month or $109 yearly, however there’s a 34-day free trial to see if it’s match.

The YNAB funds follows a zero-based funds strategy, assigning every greenback to a particular activity. So, you need to plan to spend or save each greenback you make, which is a well-tested and efficient budgeting technique.

The app walks you thru the budgeting course of and critiques many month-to-month bills which are simply neglected with primary budgeting instruments like Rocket Cash or Mint.

The spending and web price reviews are additionally sturdy. There are additionally a number of monetary calculators that can assist you plan upcoming targets.

For extra info, try our full YNAB overview.

Empower Private Dashboard

Empower Private Dashboard is arguably the most effective free web price tracker out there at the moment, as you’ll be able to hyperlink your whole banking and brokerage accounts and add guide accounts. The service contains primary spend monitoring instruments to categorize transactions and make sure you stay inside your means.

Creating financial savings targets and reviewing your funding portfolio’s asset allocation and fund charges can be potential. It has a set of planning instruments which are helpful for retirement planning, however they may attempt to promote you on their wealth administration companies.

Learn our Empower Private Dashboard overview for extra info.

BillCutterz

BillCutterz can negotiate your present payments in your behalf, and also you solely pay if it saves you cash. BillCutterz can prevent on payments corresponding to, cellphone, cable, web, satellite tv for pc radio, and extra. It takes about 48 hours after you submit the invoice to search out out if you happen to’ve acquired any financial savings.

BillCutterz prices 50% of the annual financial savings it negotiates for you. For instance, in the event that they prevent $20 a month in your cellphone invoice, they may cost $10 per 30 days for 12 months or $120. You may pay month-to-month or get a ten% low cost by paying in full immediately.

FAQs

You may ship a chat message inside the app; the everyday response time is inside in the future. Moreover, premium members obtain precedence help. An in depth on-line FAQ part additionally gives tutorials for the free and paid options.

It’s potential to watch your banking accounts, credit score scores, and subscriptions totally free. Nonetheless, you need to pay no less than $4.99 month-to-month (or $35.99 yearly) for limitless budgeting guidelines, subscription cancellation, and different in-depth entry.

Rocket Cash received’t promote your private info and protects your privateness. Nonetheless, you might obtain presents from different Rocket corporations and third-party associates.

Till mid-2022, Rocket Cash was often known as Truebill. Rocket Corporations, which additionally runs Rocket Loans, Rocket Mortgage, and LowerMyBills.com, acquired the cash administration app and renamed it Rocket Cash. Shortly thereafter, the Truebill model was sundown.

Is Rocket Cash Price It?

Rocket Cash might be an efficient approach to make a free funds if you wish to observe spending simply and don’t want hands-on assist. The paid subscription might be price it if you happen to want limitless budgeting entry and different money-saving instruments. The “Pay What’s Truthful” possibility makes it an excellent higher worth.

However whereas the app has a number of extra options, not everybody will discover all of them helpful. In case you’re on the lookout for extra in-depth instruments for budgeting or monitoring your spending, think about different choices, corresponding to YNAB or Private Capital, along with Rocket Cash.

Since it’s free, it doesn’t damage to strive it out. You may as well check drive the premium companies to see if you happen to discover worth in them.