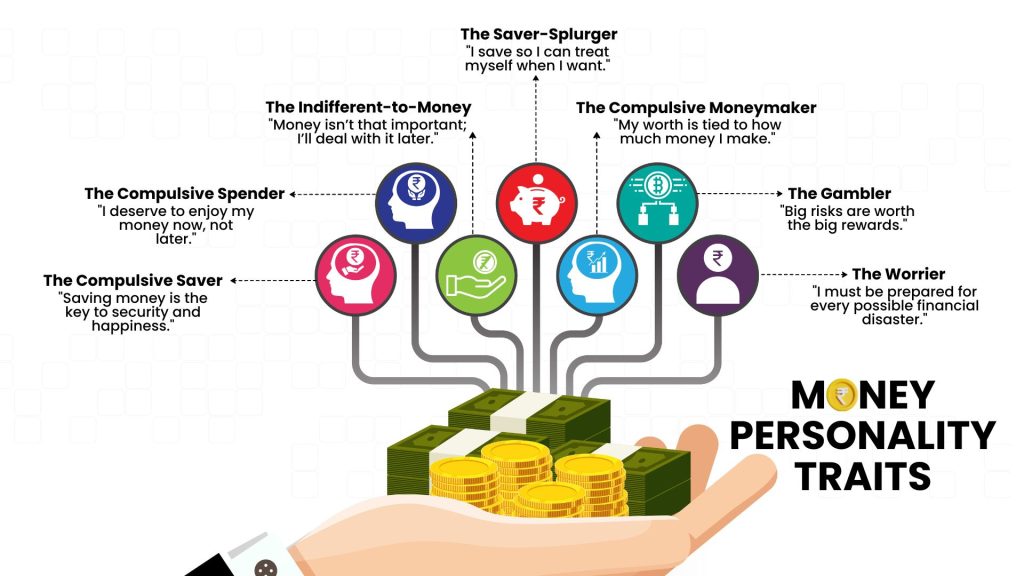

Everybody has a singular relationship with cash that influences how they save, spend, and make investments. Understanding your cash character may help you make smarter monetary choices and keep away from widespread pitfalls. On this article, we’ll discover seven cash character traits, how they have an effect on your monetary choices, and supply sensible recommendation to handle your cash higher.

1. The Compulsive Saver

Compulsive Savers are extraordinarily diligent about saving cash.

Indicators that you simply may be a “Compulsive Saver”:

- You lower your expenses obsessively, usually on the expense of having fun with life.

- You are feeling a way of management and safety when your financial savings develop.

- You might have issue spending cash, even on belongings you want.

- You skip social occasions to keep away from spending cash.

- You hesitate to spend money on alternatives that might yield greater returns.

Issues related:

- Lacking out on experiences, hobbies and actions that require spending.

- Potential pressure on relationships on account of frugality.

Cash recommendation:

Allocate a selected portion of your earnings for leisure actions and self-care.

Discover low-risk investments like bonds or balanced mutual funds to develop your financial savings whereas sustaining safety.

Outline clear objectives for each saving and spending, so you possibly can benefit from the current whereas planning for the long run.

2. The Compulsive Spender

Compulsive Spenders have a love for buying and sometimes make impulsive purchases.

Indicators that you simply may be a “Compulsive Spender”:

- You’re keen on buying and sometimes make impulsive purchases.

- You battle to withstand gross sales, reductions, and promotions.

- You have a tendency to purchase issues to really feel good or deal with stress.

- You purchase objects you don’t want or hardly ever use.

Issues related:

- Accumulating debt and monetary stress on account of frequent buying.

- Lack of financial savings for emergencies or future objectives.

Cash recommendation:

Wait 24 hours earlier than making any non-essential buy to cut back impulsive spending.

Set clear limits for discretionary spending and monitor your bills.

Remind your self of your monetary objectives, like saving for a trip or shopping for a house, to remain motivated.

3. The Detached-to-Cash

People who find themselves detached to cash hardly ever take into consideration cash.

Indicators that you simply may be “Detached-to-Cash”:

- You keep away from excited about cash or managing your funds.

- You depend on others to make monetary choices for you.

- You usually really feel overwhelmed or detached in the direction of monetary issues.

- You are feeling that cash doesn’t play an vital position in life.

Issues related:

- Whereas it’s wholesome to not be obsessive about cash, being too detached can result in monetary neglect.

- Monetary instability on account of lack of planning.

Cash recommendation:

Start by monitoring your bills and know the place your cash goes and the place you stand.

Study the fundamentals of budgeting, saving, and investing to achieve confidence in managing your funds.

4. The Saver-Splurger

Saver-Splurgers save diligently however then take pleasure in occasional splurges, usually resulting in guilt or monetary pressure.

Indicators that you simply may be a “Saver-Splurger”:

- You save diligently however then splurge on big-ticket objects or luxurious experiences.

- You usually really feel responsible after making giant purchases.

- You undergo cycles of utmost saving adopted by extreme spending.

- You save for months after which splurge a big portion on a trip or costly gadget.

Issues related:

- Problem constructing long-term wealth on account of inconsistent saving habits.

- Monetary stress after splurging.

Cash recommendation:

Put aside a certain amount every month for splurging, so it’s inside your finances and doesn’t derail your financial savings objectives.

Take into account what actually brings you happiness and focus your spending on these areas.

5. The Compulsive Moneymaker

Compulsive Cash makers are pushed by a need to continuously improve their wealth.

Indicators that you simply may be a “Compulsive Moneymaker”:

- You’re continuously on the lookout for methods to earn more money, whether or not by aspect hustles, investments, or new enterprise ventures.

- You equate your self-worth along with your monetary success.

- You battle to calm down or get pleasure from life since you’re all the time targeted on earning profits.

Issues related:

- Burnout and stress from overworking.

- Neglecting relationships and private well-being within the pursuit of wealth.

Cash recommendation:

Guarantee you might have time for rest, hobbies, and relationships, at the same time as you pursue monetary success.

Replicate on what success means to you past monetary achievements, similar to private progress, relationships, and well being.

6. The Gambler

Gamblers are drawn to high-risk, high-reward monetary choices.

Indicators that you simply may be a “Gambler”:

- You get pleasure from taking dangers along with your cash, whether or not within the inventory market, playing, or speculative ventures.

- You thrive on the thrill of probably excessive returns.

- You spend money on extremely risky shares or cryptocurrencies with out thorough analysis.

Issues related:

- Vital monetary losses on account of high-risk habits.

- Emotional stress and potential habit to the joys of playing.

Cash recommendation:

Solely allocate a small portion of your portfolio to high-risk investments and set clear boundaries.

Educate your self on the dangers concerned and make knowledgeable choices somewhat than impulsive bets.

7. The Worrier

Worriers continuously stress about their monetary scenario, usually fearing the worst even when their funds are steady.

Indicators that you simply may be a “Worrier”:

- You steadily fear about cash, even whenever you’re financially steady.

- You continuously take into consideration the long run and potential monetary crises.

- You are likely to over analyze each monetary choice.

- You examine your financial institution steadiness a number of occasions a day.

- You keep away from investments on account of worry of shedding cash.

Issues related:

- Lacking out on progress alternatives on account of extreme warning.

- Excessive stress ranges impacting your psychological and bodily well being

Cash recommendation:

Having a security web can alleviate a few of your worries. Intention for 6-12 months’ value of dwelling bills.

Unfold your cash throughout completely different asset courses to cut back danger and develop your wealth steadily.

Take into account working with a monetary advisor to create a plan that gives each safety and progress.

| Cash Persona Trait | Monetary Behaviour | Pitfalls |

| Compulsive Saver | Prioritizes saving over spending. | Neglects mandatory spending, could not get pleasure from life. |

| Compulsive Spender | Continuously makes impulsive purchases. | Accumulates debt, monetary stress. |

| Detached-to-Cash | Neglects coping with funds. | Faces monetary instability or dependence on others. |

| Saver-Splurger | Alternates between saving and splurging. | Inconsistent financial savings, monetary pressure. |

| Compulsive Moneymaker | Obsessive about growing wealth. | Threat of burnout, neglects life satisfaction. |

| Worrier | Overly cautious, continuously anxious about cash. | Misses out on alternatives, overly conservative. |

| Gambler | Interested in high-risk investments. | Potential for important monetary losses. |

Conclusion

Understanding your cash character is vital to creating higher monetary choices. By recognizing your tendencies, whether or not you’re a Worrier, Spender, or Moneymaker, you possibly can take steps to handle your funds in a manner that aligns along with your objectives and values. Bear in mind, the aim is to not change who you’re however to make use of your strengths to your benefit and mitigate any potential weaknesses.